Partnering with Mos: The Next Challenger Bank

By Jess Lee

Published February 3, 2022

When I met Amira Yahyaoui in early 2020, she made a strong impression right from the start. From her bright pink peacoat to her incredible history as a Tunisian human rights activist, she stood out in almost every way. Our 45-minute meeting turned into several hours. When I tried Mos’ product, I was impressed by how it transformed the tedious process of filling out financial aid forms into something fun and delightful, with bold maximalist colors and helpful tooltips from a raccoon mascot. I met the rest of the then-six-person team, who wowed me with their chemistry, talents and passion for the Mos mission of tearing down all financial barriers to opportunity. I also spoke with customers who shared life-changing stories of how Mos helped them afford college. One valedictorian got a full ride to Berkeley. Another student received $4,000 of aid, which made the difference between going to college or not.

It was clear that Mos had tapped into its community of passionate users and was applying their feedback. What was less clear was how much Mos’ business could grow. At the time, customers paid $150 to use the app’s financial aid finder. On one hand, it was a bargain: the average person found $16,430 in aid. On the other, $150 was a steep price point for young students.

But if Mos’ business wasn’t an obvious bet from the start, Amira and her team were—and one of Sequoia’s biggest takeaways after 50 years is to always dream with founders. We often write a “pre-parade” in our investment memos, imagining what would happen if everything went exactly right. For Mos, we imagined the following: By helping young people navigate the first major financial transaction of their adult lives—paying for college—Mos can earn the trust of its consumers and position itself as a lifelong financial advisor, expanding to banking, credit cards, loans, insurance and more.

The path to that future wasn’t always crystal clear. Shortly after we partnered, the COVID-19 pandemic hit, and 70% of Mos customers had difficulty paying due to job loss and dropping out of school. But we knew Amira and her team were building a product that had captured the hearts and minds of students. Mos rallied and pushed forward, interviewing their community to better understand their financial lives.

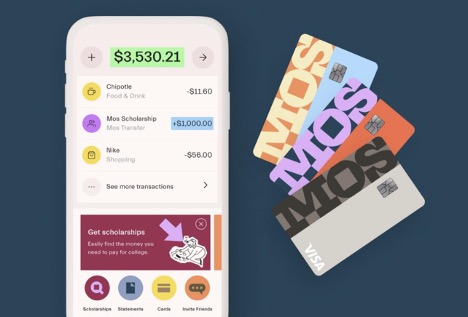

Less than two years later, that pre-parade dream is on its way to becoming a reality. Mos has helped more than 400,000 students obtain financial aid, and has evolved into a modern banking service offering a no-fee debit card, P2P payments, direct deposit and more. The app now connects users to the largest scholarship pool in the U.S. and, through its chat feature, offers personalized one-on-one financial aid support. The team is also producing educational content on both TikTok and the Mos website that empowers students to take control of their finances. And last fall, when Mos launched its bank, it went viral—and became the only fintech app (and the only female-founded app) to crack the App Store’s top 3. (The story of this crazy weekend is best told by Amira.)

Mos’ vision is resonating with students. We’ve learned that Gen Z is hungry for a total reimagining of financial services and guidance, and eager to avoid the student debt so many millennials face. They’re asking: Why can’t a bank be more than just a place to store money and earn interest? Why can’t it help you find money, and manage it smartly? And why can’t it teach you about topics like financial aid, stocks, and crypto—and make the learning process fun?

With the $40M Series B round announced this week—led by Tiger Global Capital with participation from current investors including Sequoia, Lux, Expa, Emerson Collective and Khaled Helioui—we are thrilled to support the Mos team as they continue pushing toward their vision. The rise of fintech startups like Chime, Robinhood and Opensea has made it clear that consumers are willing to embrace digital-native financial products, and crypto and DeFi have proven that a financial revolution is coming. I can’t imagine anyone better than a former revolutionary like Amira to help create the next generation of banking.

If you’re also excited about Mos’ mission, please reach out. We are hiring across all teams.